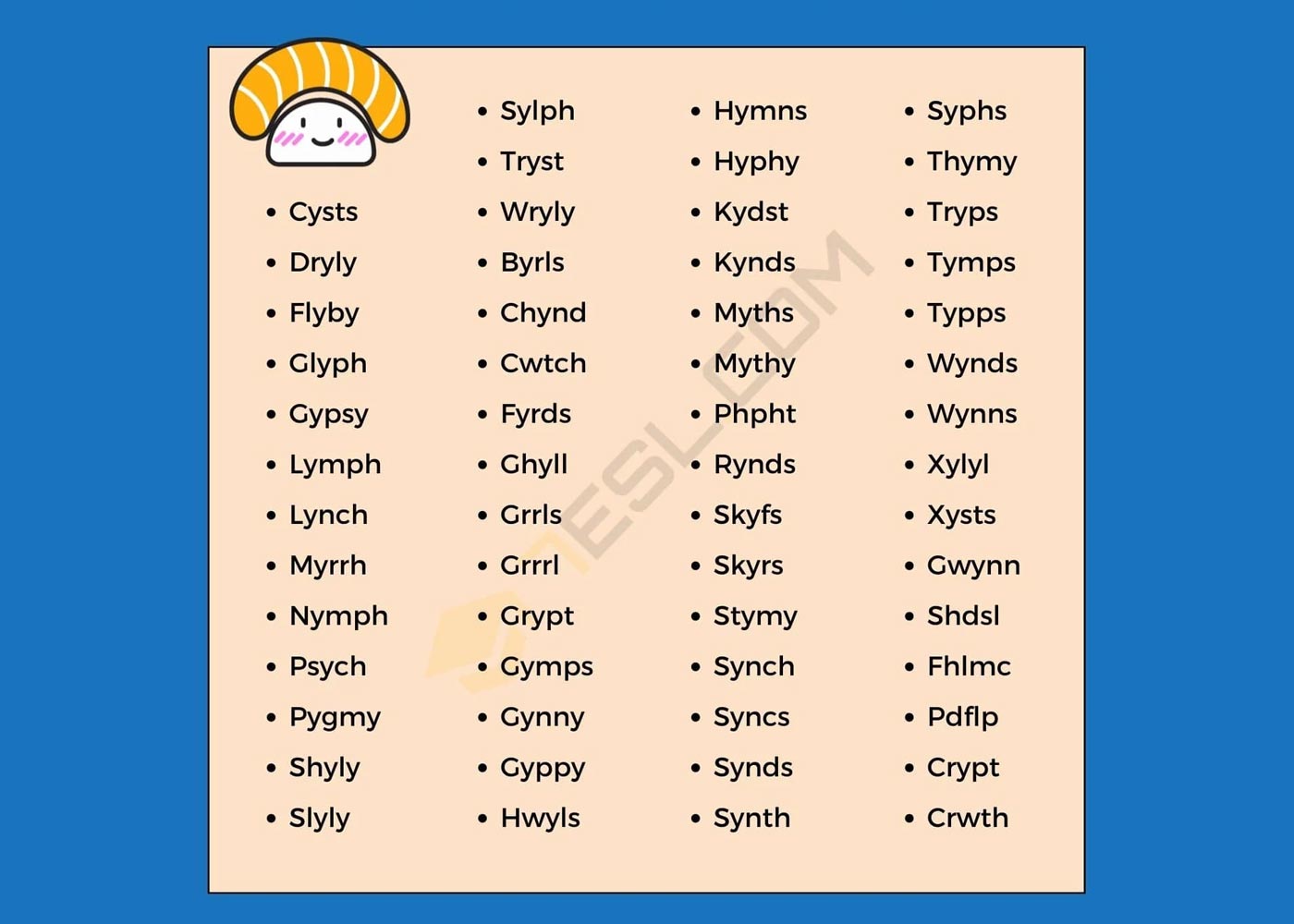

The majority of property insurance policies include a coinsurance clause. A coinsurance provision requires the insured to ensure the covered property is up to a certain percentage of its full value, usually 80, 90, or 100 per cent. If a loss occurs and it is determined that the limits purchased are less than what is required by the coinsurance clause, the loss recovery will be limited to the same percentage of loss as the ratio of insurance amount carried to the insurance amount. With that being said, let's now talk about Everything there is to know about coinsurance and I hope I'll be able to answer all of your questions.

What is the purpose of coinsurance in a commercial property policy?

"Insurance companies are generally required by law to provide comprehensive coverage for your risk. If something happens while you're applying for car insurance—a collision with another vehicle or an accident involving injury and damage—you'll need some kind of protection from both sides." –From the website of the Better Business Bureau (US). Since these policies were introduced, it appears that they have always had their products, but as time passed, no other insurers came forward, so how would we know where coinage is?

What is coinsurance in a mortgage?

Insurance companies use coinsurance as part of their "insure to value" strategy.

If you have such a clause, you will be required to ensure your property to a minimum value percentage (such as 80%, 90%, or 100%) of its actual value, or you will face a penalty if you file a property insurance claim. Coinsurance clauses can be found in a variety of insurance policies, not just commercial property insurance. These provisions can also be found in dwelling forms, homeowner's insurance, health insurance, federal flood policies, and even D&O policies.

Let's take an example below:

Example

Assume you have a $500,000 property and your property policy has an 80 per cent coinsurance clause and a $2500 deductible. Due to the 80 per cent coinsurance clause, you must keep at least $400,000 in insurance coverage on your property (80 per cent * $500,000). If you do not, you will be penalized if you file a claim.

However, suppose you're not concerned about having a claim and want to save a little money, so you only ensure you are building up to a value of $300,000. The property manager calls one day to report a fire at the building that has caused $50,000 in damage. You instruct the property manager to contact the insurance company and file a claim.

But what will the insurance company do about the calculation of coinsurance?

In this case, the insurance company will perform a calculation by dividing the amount of insurance you have ($300,000) by the minimum amount of insurance required ($400,000).

They'll come up with 75% ($300,000 divided by $400,000 equals 0.75 or 75%).

The claim will then be multiplied by 75%, and the deductible will be subtracted. So, if you file a $50,000 claim, the insurance company will only pay you $35,000 because you under-insured your building.

What is the purpose of coinsurance provisions Quizlet?

A typical coinsurance provision in health insurance requires the insured to pay 20, 25, or 30% of covered medical expenses above the deductible, up to a maximum annual limit. The goals are to reduce premiums and prevent the overuse of policy benefits. Coinsurance is a clause used in insurance contracts on property insurance policies such as buildings by insurance companies. This clause ensures that policyholders insure their property for a reasonable amount and that the insurer receives a reasonable premium for the risk. Coinsurance is typically stated as a percentage.

Most coinsurance clauses require policyholders to insure a property for 80, 90, or 100 per cent of its actual value. For example, a building with a replacement value of $1,000,000 and a coinsurance clause of 90% must be insured for at least $900,000. The same building must be insured for at least $800,000 with an 80 per cent coinsurance clause.

What does 100 coinsurance mean on property insurance?

Property insurance coinsurance is a little different. Coinsurance clauses essentially require the insured to purchase insurance coverage that is proportional to the value of the property being insured. If the insured buys a lower insurance limit, he or she accepts responsibility for the shortfall in coverage. The "co" in coinsurance is derived from this.

This simply means that you have a 100% of coverage limit. Let's assume that you have a $100,000 property and your coinsurance clause needs 100 per cent coverage. This means that your coverage limit cannot be less than 100% of $100,000 – it must be $100,000.

Finally, If you want complete coverage, make sure your insurance coverage is equal to the amount required by the coinsurance clause. You would need to know the property's value to do so. You should also be aware of the property insurance limit that you have purchased. Have your property appraised regularly, and keep your coverage limits up to date. I know how challenging it can be when it comes to maths and coinsurance feels just like maths. So I hope this article helps a lot.

Comments (0)

Write a Comment